Estimate Your Low Mortgage Rate

Must be eligible for LorMet membership to apply

Today’s Rates

Rate lock period is 30 days. The details listed are for informational purposes only. It is provided to assist you in determining an estimate of lender fees that may be present and an estimate of your proposed monthly mortgage payment. There are other costs you will incur, not associated with the lender fees. These costs are paid to third parties involved and are standard in all mortgage transactions, such as title/attorney costs, appraisal, taxes and escrows. You will receive an official Loan Estimate after applying, which will provide you with a detailed breakdown of all closing costs.

Buy With Confidence

Competition is extreme in today’s housing market. Quick, reliable financing could be what puts your offer over the top!

- Fill out our quick online application

- Get a pre-approval* from one of our experienced loan officers

- Shop for a new home, hassle-free!

*Pre-approval is not a commitment to lend; you must submit additional information for review and approval.

Lending Partners You Can Trust

United Wholesale Mortgage (UWM), Union Home Mortgage (UHM), Mr. Cooper, Flagstar and their Account Executives are not affiliated with LorMet Community Federal Credit Union. Use of any party is not required by the other parties.

Years Of Experience

Million in Assets

Loyal Members

Billion Loans Granted

LorMet Has a Mortgage Solution for Your Specific Needs

Our expert lending team will guide you through our wide range of available mortgage options, and find the perfect home loan for your specific scenario!

1 Veterans, Servicemembers, and members of the National Guard or Reserve may be eligible for a loan guaranteed by the U.S. Department of Veteran Affairs (VA). A Certificate of Eligibility (COE) from the VA is required to document eligibility. Restrictions and limitations apply.

* Average of 24 days to close based upon 63 all purpose mortgage loans closed through LorMet Credit Union from 1/1/24 – 12/31/24. According to ICE Mortgage Technology, the national average time to close an all purpose home loan in January 2025 was 46 days. The closing process can range from a week to two months or longer. Factors that affect the timing include whether or not you’re buying the home with a mortgage, the kind of mortgage, and the type of property you’re buying.

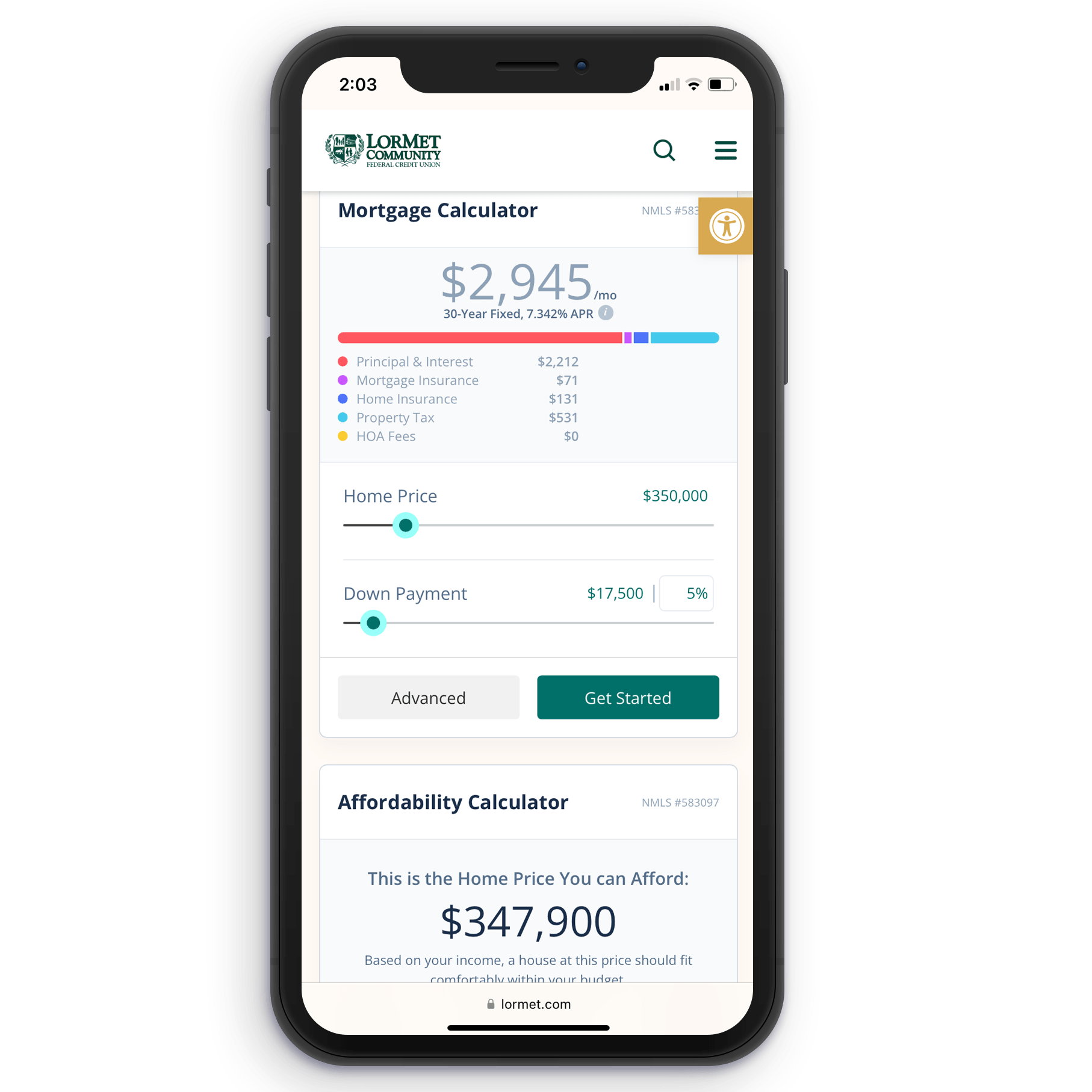

Mortgage Payment Calculators