April is Financial Literacy Month

Engaging with the future leaders of Lorain County and promoting financial literacy education remains a crucial part of LorMet Credit Union’s mission. Over the past year, we continued to expand our financial literacy outreach, presenting to high school students from more than ten local school districts, as well as professionals. Let’s look back at the impact we were able to achieve throughout the year.

Table of Contents

Mortgage 101 at Amherst Steele High School

As seniors from Amherst Steele High School near graduation, their Financial Literacy class with Mrs. Kamczyc decided to cover mortgage loans. Who better to simplify mortgage terms than the LorMet Mortgage Solutions team? Our Mortgage Lending Manager, Alexis Kroupa, and Director of Marketing, Andrew Krieger, presented to students in two separate class periods on April 15th, 2024, explaining different types of mortgage loans to the students, and terms such as DTI and LTV. When these students go to buy their first home, they will be well prepared!

Clearview High School

To kick off Financial Literacy Month, our team visited Clearview High School in Lorain, presenting to high school students of all ages in Mr. Majoras’ class. The students learned about the benefits of banking with a credit union, starting a savings account early, and pitfalls to avoid when building credit from a young age. For our Director of Marketing, Andrew Krieger, and Senior Loan Officer, Lindsey Perez, making an impact on the financial knowledge of these students was a privledge!

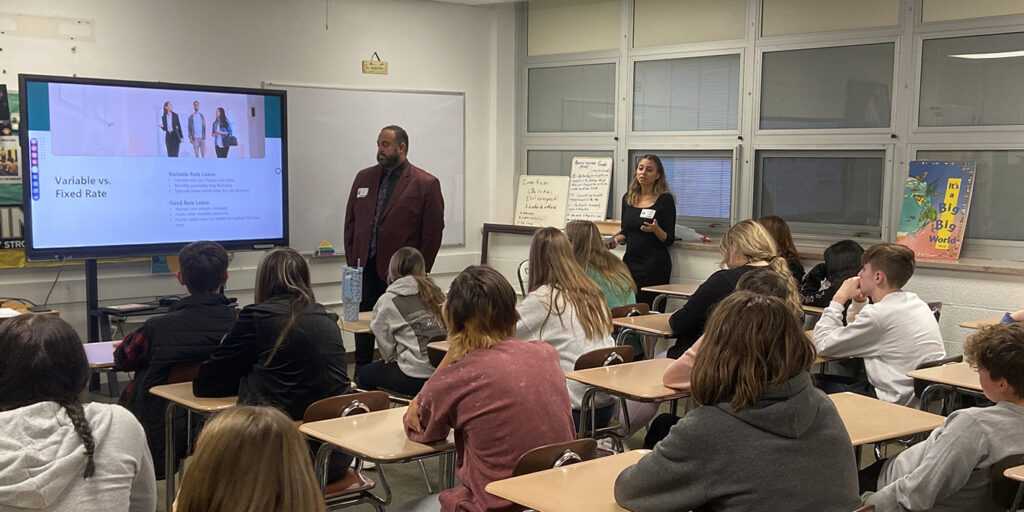

Amherst Steele High School

In October, our team visited Marion Steele High School in Amherst, presenting to seniors in Mr. Walker’s financial literacy class. It was a rewarding experience for Gil Navarro (Amherst Branch Manager), Andrew Krieger (Director of Marketing), and Alexis Kroupa (Mortgage Lending Manager). The students learned not only about the importance of building credit, but how economic and historical factors can influence what interest rates are offered.

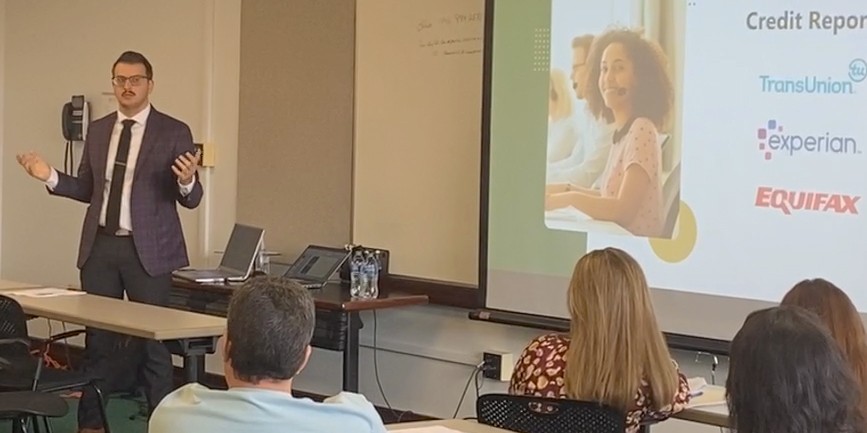

Murray Ridge Center

Professionals who can impact the lives of others with increased financial literacy knowledge are also a priority for us to reach. That’s why our team presented at the Lorain County Board of Developmental Disabilities In-Service Day this October. Hosted at Lorain County Community College, the event helped employees of the Murray Ridge Center better understand how to lead others to financial stability. Charles Elswick (Lending Manager), Lindsey Perez (Senior Loan Officer), and Andrew Krieger (Director of Marketing) were all grateful for the opportunity to present on these important topics.

Lorain High School

Our team always enjoys working with the juniors and seniors at Lorain High School, and it was a pleasure to visit them again this November. Lindsey Perez (Senior Loan Officer) and Andrew Krieger (Director of Marketing) worked with small groups of students on their financial literacy knowledge and even prepared a mock loan application activity for the students. By the end of the interactive activity, students were more prepared for their first experience in a lending office.

Effective Leadership Academy

Each December, LorMet hosts high school students from Effective Leadership Academy at our Amherst Branch. This program features highly engaged students from more than ten districts in the Lorain County area. It was a privilege for Gil Navarro (Amherst Branch Manager), Andrew Krieger (Director of Marketing), and Alexis Kroupa (Mortgage Lending Manager) to share insights on financial literacy, discuss career paths, and provide an exclusive tour of the branch. If these students are any indication, the future of our community is in great hands!

LorMet Credit Union looks forward to the opportunity to further grow our commitment to promoting financial literacy in our community. By providing financial education, we empower young people and professionals with the tools they need to make informed financial decisions. LorMet encourages interested parties to contact Andrew Krieger, Director of Marketing regarding future financial literacy presentations at (440) 960-6600.